2024 iGaming Trends in Canada

In this report, we examine and compare the preferences of Canadian iGamers across the generations. With insightful data and regional trends, this study provides an overview of the state of iGaming in Canada in 2024.

Methodology

Our study analyzed over 285,000 Canadian iGaming players using player data from Jackpot City, focusing on four key generational groups:

- Gen Z (22-26)

- Millennials (27-42)

- Gen X (43-59)

- Boomers (60-66+)

We examined customer behaviour across five game categories—Slots, Parlour Games, Video Games, and Table Games—to understand the preferences of the provinces and territories in Canada.

Using StatCan’s Q2 2024 population prediction estimates, we identified regional preferences and per capita popularity of iGaming alongside our generational trends. The results showed that Gen Z and Millennials dominate the Canadian online gaming space, but exact game preferences are more nuanced, highlighting important shifts in how these younger generations engage with online gaming platforms.

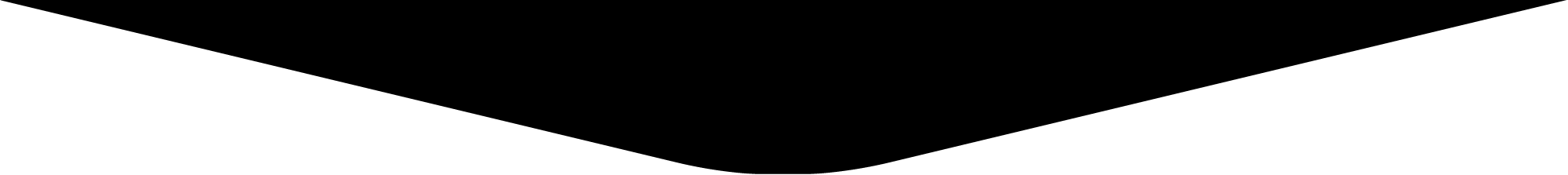

Generational Divide: A Closer Look at the Numbers

Across Canada, distinct generational trends are shaping the iGaming landscape. Each generation—Gen Z, Millennials, Gen X, and Boomers—brings its own gaming preferences and levels of engagement, as well as iGaming participation.

Gen Z (22-26) has the highest engagement in regions like Nunavut and Prince Edward Island, with over 25% of the population engaged in iGaming.

Millennials (27-42) dominate iGaming participation across most provinces, particularly in Alberta (64.54%) and Saskatchewan (65.13%), confirming their strong influence in the industry.

Gen X (43-59) shows a significant presence in Ontario (25.58%) and British Columbia (25.54%), reflecting a balanced engagement in more traditional forms of gaming.

Boomers (60-66+) remain the least represented demographic, with the highest engagement in Yukon (10.75%) and Ontario (9.08%).

Ranking the Locations by Player Count

Certain provinces have emerged as hotbeds of iGaming activity, and some locations are clearly preferred by specific age groups.

Ontario and Quebec rank at the top in terms of overall player count.

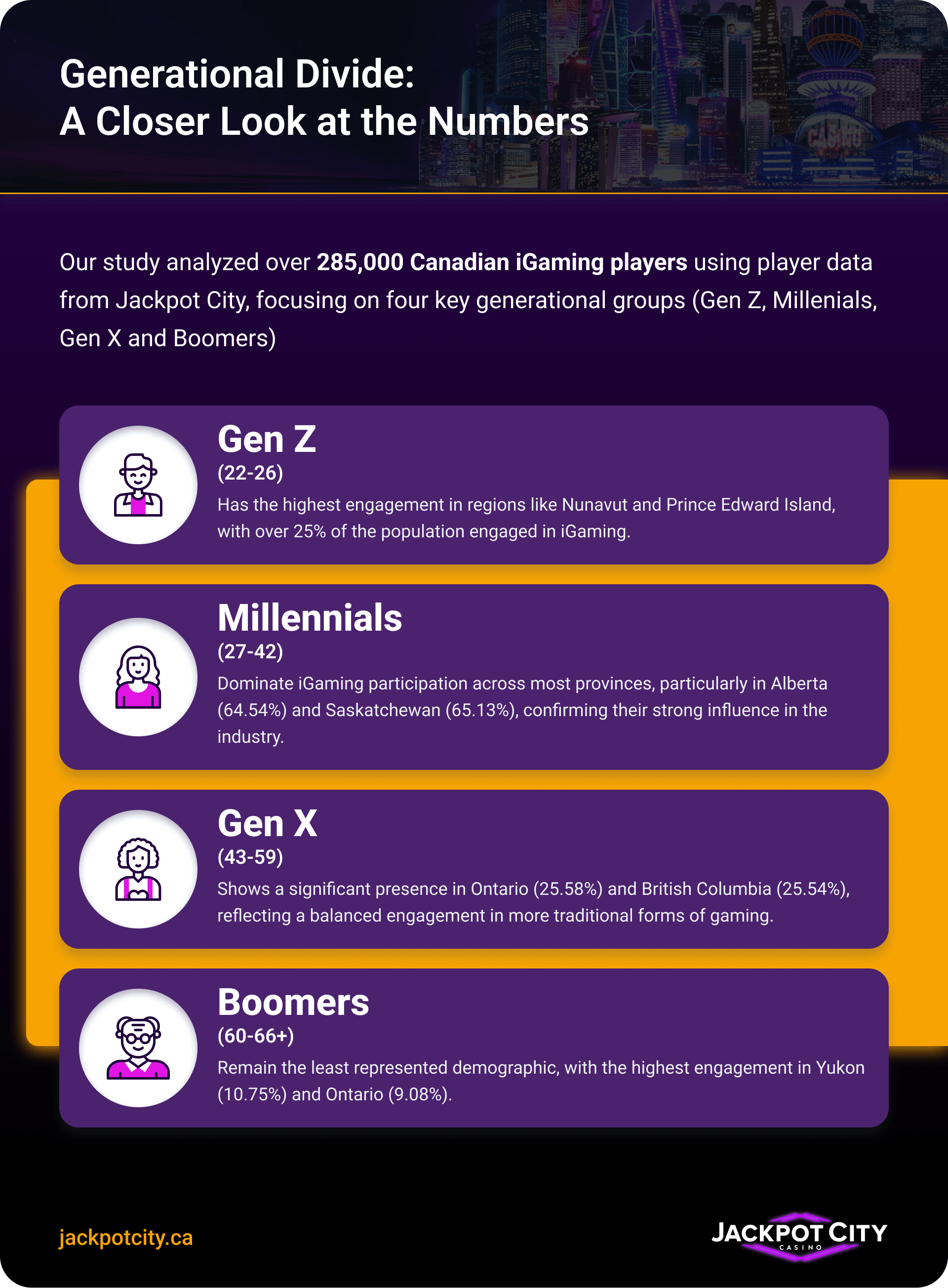

Per Capita Breakdown

Ontario is home to 18% of all active players, while Quebec slightly leads with 23.4% of all active players.

Among these, Millennials form the most active group, making up nearly half of the player base in both provinces (42.06% in Ontario, 46.54% in Quebec).

- Nunavut - 132.16 players per 1,000 people

- Northwest Territories - 55.88 players per 1,000 people

- Saskatchewan - 22.62 players per 1,000 people

- Newfoundland - 14.99 players per 1,000 people

- Manitoba - 14.86 players per 1,000 people

- Yukon Territory - 11.26 players per 1,000 people

- New Brunswick - 11.06 players per 1,000 people

- Alberta - 9.83 players per 1,000 people

- Nova Scotia - 9.10 players per 1,000 people

- Prince Edward Island - 8.44 players per 1,000 people

- Quebec - 7.44 players per 1,000 people

- British Columbia - 5.55 players per 1,000 people

- Ontario - 3.26 players per 1,000 people

Alberta shows significant player engagement. 16.6% of all participants, and Millennials once again dominate the scene with 50% of the total player base.

In smaller provinces like Saskatchewan, younger players (Gen Z) represent a larger proportion of the total iGaming population (31.75%), highlighting the regional variation in engagement trends.

The North also presents an interesting contrast, with Nunavut and the Northwest Territories exhibiting significantly higher participation from younger generations, with 47.79% and 36.74% Gen Z participation, respectively.

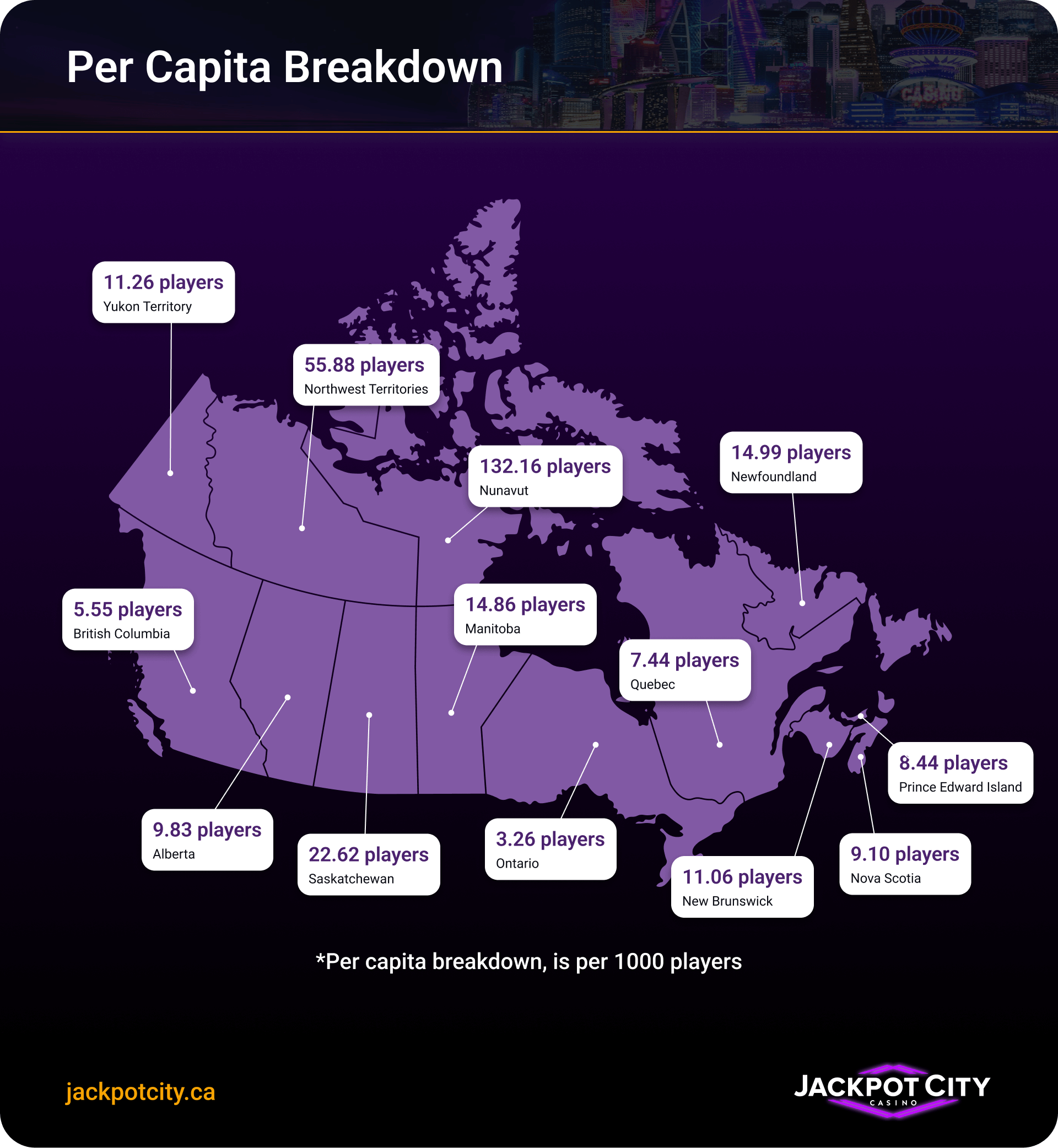

Top Game Preferences Among the Canadian Population

Slots remain a favourite among Millennials (27-42) and Gen X (43-59).

Millennials dominate in provinces like Alberta (64.54%) and British Columbia (56.44%), where their preference for quick and engaging gameplay is clear.

Gen X also shows substantial engagement in slots, particularly in Ontario (25.58%) and British Columbia (25.54%), suggesting that these two generations share an affinity for this fast-paced game type.

Parlour Games are predominantly favoured by Millennials, with the highest engagement in Saskatchewan (65.13%).

Gen X follows closely behind, particularly in provinces like Ontario (25.58%) and British Columbia (25.54%), reflecting a balanced interest in this mix of strategic and casual gaming.

Video Games are most popular among Gen Z (22-26), particularly in the northern territories like Nunavut (25.22%) and Prince Edward Island (26.07%).

This younger generation has a strong preference for digital, interactive gaming platforms, highlighting their alignment with mobile and video gaming.

Table Games, both live and non-live, continue to attract older generations.

Gen X (43-59) and Boomers (60-66+) show a higher inclination toward these traditional gaming formats.

Ontario (25.58% Gen X) and British Columbia (25.54% Gen X) lead in table game participation.

While Boomers represent a smaller but significant portion, particularly in Yukon (10.75%) and Ontario (9.08%).

What's Going On Up North?

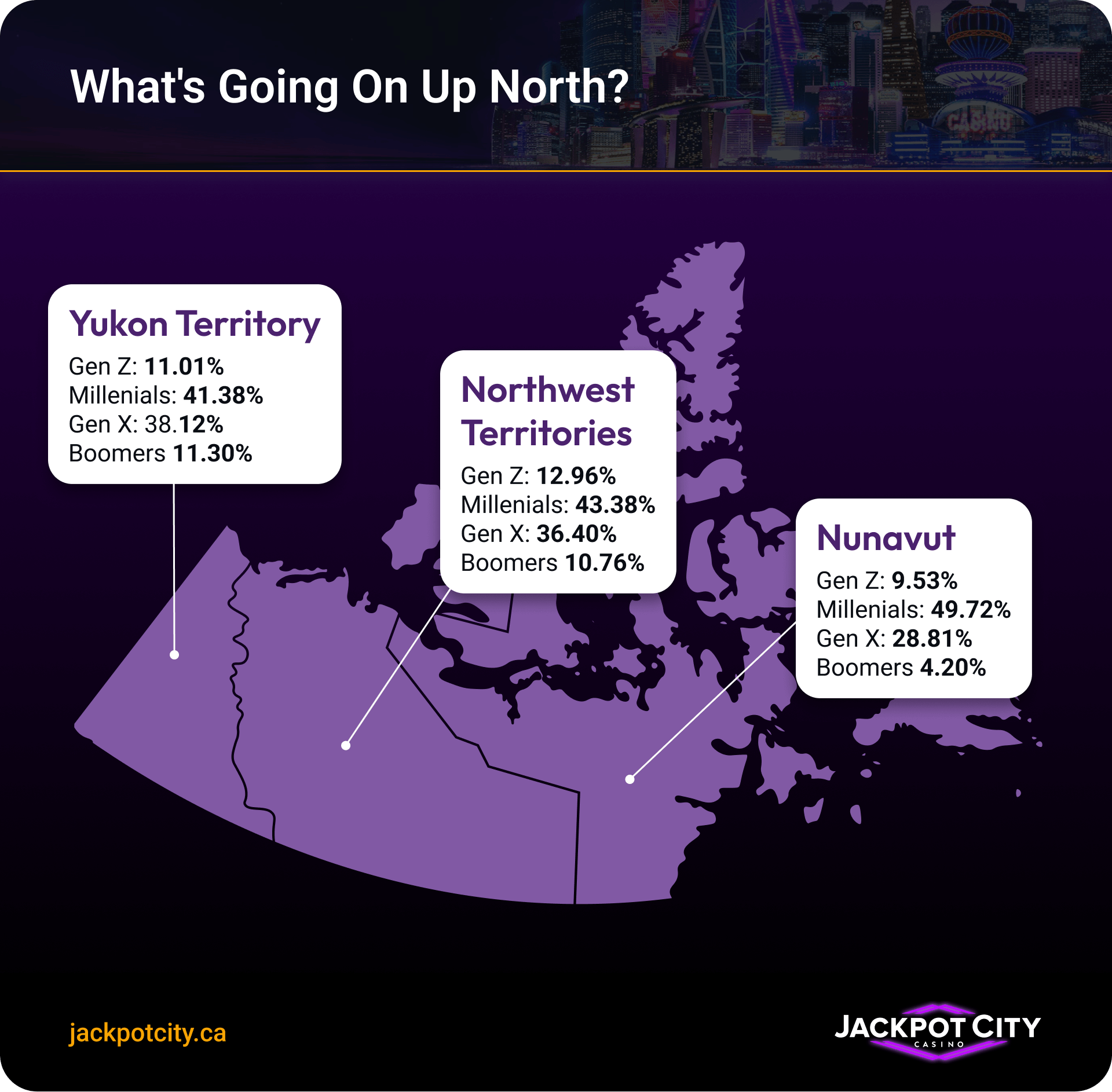

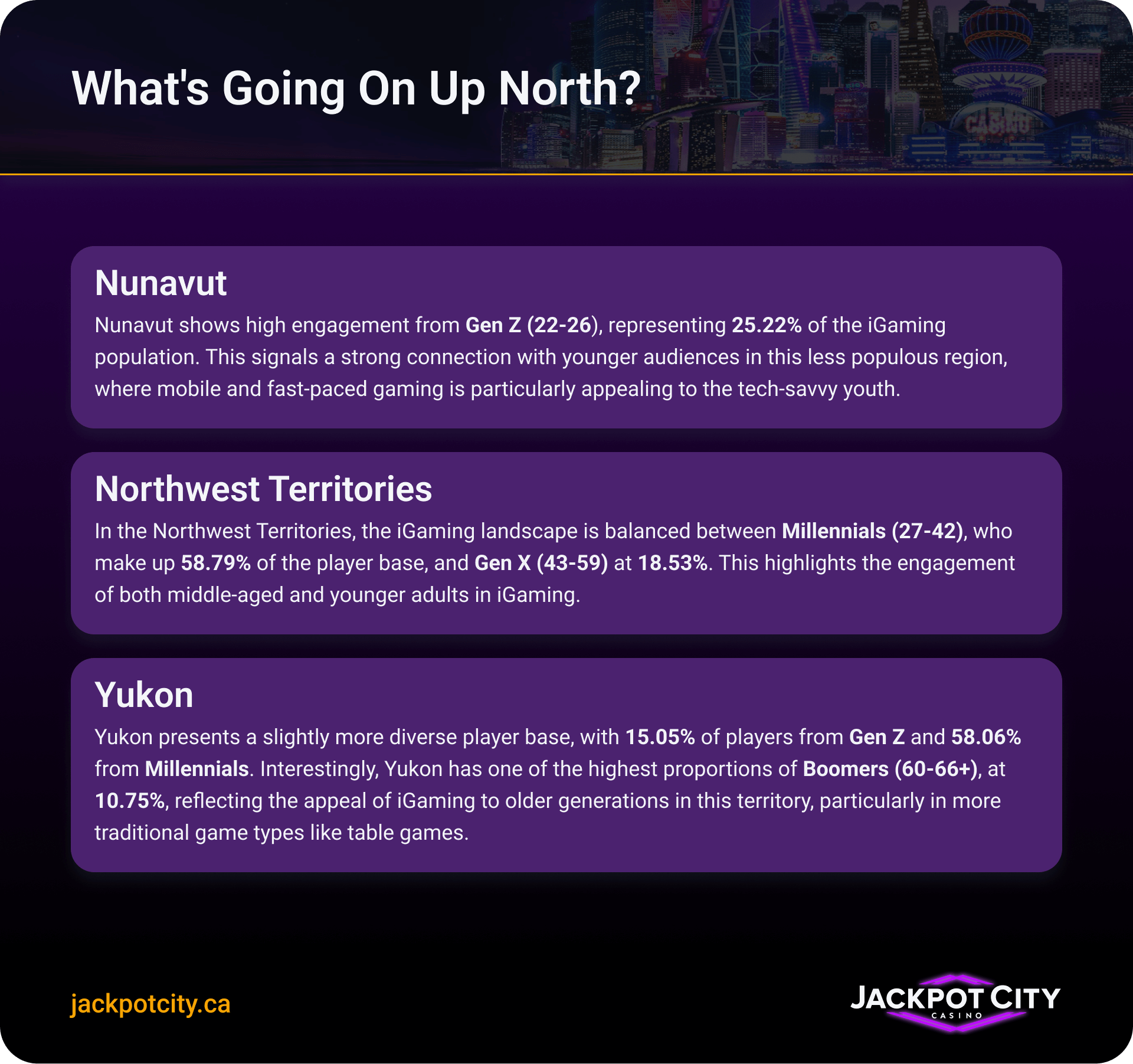

The northern territories—Nunavut, Northwest Territories, and Yukon—offer an interesting perspective on iGaming demographics.

Nunavut shows high engagement from Millenials, representing 49.72% of the iGaming population. Gen X holds strong, representing a further 28.81% of the population.

In the Northwest Territories, the iGaming landscape is balanced between Millennials (27-42), who make up 43.38% of the player base, and Gen X (43-59), at 36.40%. However, NWT also holds the highest engagement among Gen Z (12.96%)compared to the other Northern territories.

Yukon presents a very balanced player base, with 11.01% of players from Gen Z and 11.30% from Boomers. Gen X and Millenials hold strong in the middle, with 38.12% and 41.38% of the player base, respectively.

Regional Preferences for Specific Game Types Across Canadian Provinces

The available data on iGaming activity across Canada shows that different regions exhibit unique preferences for Slots, Parlour Games, Video Games, and Table Games. This section explores how players from various provinces and territories engage with these specific games, providing insights into regional gaming behaviours and potential market opportunities for operators.

Slots: A Game for Millennials and Gen X

Even in the online format, slots continue to be the most popular game type among key demographics, including Millennial (27-42) and Gen X (43-59) players. These generations, who were likely first introduced to physical slot machines before switching to iGaming, showed their preference for the traditional game across Canada:

- Alberta: Millennials are the key drivers here, representing 64.54% of the player base, followed by Gen X with 20%. Alberta’s younger population favours quick engagement through slots, making it a critical market for this game type.

- Quebec: Millennials also lead in Quebec, accounting for 63.42% of slot players. Gen X players make up 19.29%, showing balanced participation across both age groups.

- Ontario: While 55.34% of slot players are Millennials, 25.58% of participants are Gen X, indicating a strong engagement from middle-aged players in Ontario’s gaming landscape.

- Northern Territories: In the Northwest Territories and Yukon, the preference for slots is driven by Millennials (58.79% and 58.06%). However, Gen Z (22-26) also contributes significantly, particularly in Nunavut, where they make up 25.22% of the player base.

The Inter-Provincial(Ontario vs. Quebec) Battle

Poutine and winning money- what a better combo? Ontario and Quebec are the most populated provinces, and they play a key role in the Canadian iGaming market.

Here are some key differences between the provinces of Quebec and Ontario.

Key Differences:

Quebec has almost double the rate of participation, with 7.44 players per 1000 residents, compared to 3.26 in Ontario.

Millennials are the driving force in both provinces, but their dominance is more pronounced in Quebec than in Ontario. 63.42% of Quebec residents and 55.34% of Ontario residents contribute to the Igaming market.

Boomers are more active in Ontario (9.08%) than Quebec (6.38%), indicating that older generations are more involved in iGaming in Ontario, particularly in more traditional game categories like table games.

Gen X players are more engaged in Ontario (25.58%) compared to Quebec (19.29%), suggesting that Ontario's iGaming market may be more balanced in terms of generational representation.

|

Quebec |

|

|

Ontario |

|

Parlour Games: Popular Among Millennials

Parlour Games, which involve a mix of strategy and casual play, see the highest engagement from Millennials (27-42), followed by Gen X (43-59). These games offer a social element that appeals to these generations, especially Millennials, who are tech-savvy and enjoy interactive gaming.

- Saskatchewan: Millennials (65.13%) dominate the parlour games scene here, showing a strong preference for strategic yet accessible gaming formats. Gen X (16.45%) follows, contributing significantly to the player base.

- British Columbia: Millennials (56.44%) also lead parlour game engagement in BC, while Gen X (25.54%) shows solid participation. The social and strategic nature of parlour games is popular with these generations.

- Ontario: In Ontario, Millennials (55.34%) are the most active players in parlour games, with Gen X (25.58%) contributing to a balanced engagement profile.

Video Games: A Stronghold for Younger Players

Unsurprisingly, Video Games are naturally the most popular among Gen Z (22-26), who grew up with video gaming consoles and mobile devices. Their preference for interactive and competitive digital gaming is evident across the northern territories and smaller provinces.

- Nunavut: Gen Z (25.22%) shows the highest engagement in video games in Nunavut, reflecting their comfort with mobile-first and digital gaming platforms.

- Prince Edward Island: Similarly, Gen Z (26.07%) leads video game participation in PEI, where younger players drive engagement.

- Northwest Territories: Millennials (58.79%) also participate strongly in video games, particularly in the Northwest Territories, where older generations are more likely to engage with traditional game types.

Table Games: The Popular Choice for Gen X and Boomers

Table Games, both live and non-live, appeal primarily to Gen X (43-59) and Boomers (60+). These games require strategy, skill, and patience, making them a popular choice among older generations.

- Ontario: Gen X (25.58%) players are the most engaged in table games, followed by Boomers (9.08%), showing a clear preference for games like poker, blackjack, and baccarat.

- British Columbia: Table games are similarly popular with Gen X (25.54%) and Boomers (8.94%), indicating a strong traditional gaming culture in BC.

- Yukon: While Millennials (58.06%) dominate overall gaming participation in Yukon, Boomers (10.75%) have a notable presence, reflecting the older generation’s engagement with strategic, slower-paced table games.

The iGaming landscape in Canada is shaped by distinct generational trends and regional differences.

Millennials are the driving force behind the industry's growth, particularly in provinces like Alberta and Quebec.

Meanwhile, Gen Z dominates the northern territories, where younger audiences are significantly shaping the future of iGaming.

As the industry continues to evolve, provinces like Ontario will play a critical role in engaging older generations, while northern regions could provide valuable insights into how digital gaming can cater to younger, more dispersed populations.

Canada's iGaming future is multi-generational and multi-regional, reflecting the diverse interests and engagement levels across the country.